Wednesday, March 23, 2011

Monday, March 21, 2011

Question 7

| I had to accept a 47% pay decrease or be unemployed |

| I was unemployed multiple times during the recession |

| I have taken a cut in pay |

| My husband and I have both been unemployed for more than 1 year. |

| Being self-employed, one could say I was unemployed before the recession and at some point during it |

| I have been unemployed for nine months, my husband has been unemployed for 16 months |

| Friends and extended family have been unemployed during the recession |

| I am currently unemployed |

| As an independent, less contracts |

| Many friends are out of work, underemployed or worrying about remaining employed |

| my hours were cut by 40% |

| I have been unemployed since 04/09 |

Friday, March 18, 2011

Question 2

The opportunity to be prosperous, even rich. This is the dream which has persisted since the early 1800s. |

| I used to think owning your own home, now I'm not so sure. |

| Happiness - ability to be happy through good and bad times |

| Freedom |

| All of the above. I dream big! |

| Originally it was Opportunity, now not so sure. |

| Too many people are paying the price for others lack of ethics. All too often our current system of government is rewarding those who choose not to work, or those who are manipulating the systems that were put in place to protect people from economic disaster. However, today we are seeing more and more the rewards going to those who are abusing the system. This is not an incentive to work hard or invest in the "dream" that is more now a Mirage than a possibility for a hard working, honest person. I am blessed with a good life, others should have that same opportunity without the fear of unethical people and businesses taking that away. |

| Liberty and Security. You can't have one without the other. |

| Money driven and egocentric opportunity |

| The American Dream means owning a house and spending money - not much of a dream if you ask me, very lame. |

| I fear that 'equality' (as in equal before the law) has been redefined as lowest common denominator and removed any attempt at meritocracy |

Wednesday, March 16, 2011

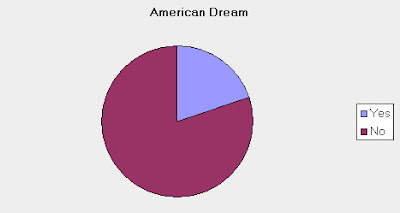

Question 1

Comments:

I never thought much about "the American Dream" and I don't know what it's supposed to mean. |

I never believe in it |

I never believed in the American Dream. |

Belief in the American Dream and what defines that dream changed long before the current recession. |

To a large degree it has delayed my ability to possibly attain them |

The American Dream is a marketing tool, always has been. |

I knew the depression was coming now it is here. |

hard to say: I'm an ex-pat (left the States for the |

it has destroyed my faith in the current political system |

didn't believe in it! We are less mobile between income quintiles than most European countries, for starters. |

Survey Response Rate

By June 15, 2010, 122 people responded. The survey closed in November 2010 with 162 responses.

LinkedIn Groups

The LinkedIn Groups were notified during June 1-June 15, 2010. The groups were:

- Adidas Group Alumni & Employee Network

- Allied Domecq Alumni

- AMA – American Marketing Association

- Babson College

- Babson College

- Babson MBA Alumni

- Boston

- Boston Marketing Group

- Cape Cod Non-Profits

- CASE District 1 2011 Conference

- Case Communications

- Cause Marketing Forum

- Chief Marketing Officer (CMO) Network

- Corporate Communications Executive Network

- Direct Marketing Fundraisers Association

- DMA Nonprofit Federation

- DMW Direct Fundraising

- Higher Education Public Relations and Marketing Group

- International Fund for Animal Welfare

- Internet Marketing Association International

- Marketing Executives Group

- Marketing Executives Networking Group

- MPNBoston

- NEDMA – New England Direct Marketing Association

- Non Profit & Philanthropic Job Board

- Non Profit Network – MojaLink

- Non Profit Professionals

- Non-Profit Marketing

- NonProfit Message – Communications & Marketing

- On Fundraising, Hosted by AFP

- On Higher Education, Hosted by AFP

- On Social Media, Hosted by AFP

- Public Relations and Communications Professionals

- Reebok, Rockport, GNC alumni

- Serono Alumni

- Social Media for Higher Education

- Social Media Marketing Mavens

- The Chronicle of Philanthropy

- The Publicity Club of New England

- Tim’s Strategy – Ideas For Job Search, Career, And Life

- University of Massachusetts at Boston

- Women In Development

Survey of the well-educated

In early 2010, data was not available that provided the facts on when the recession ended. We still believed we were in the middle of the Great Recession in May 2010 when I designed a survey for well-educated, well-paid individuals and their views of the American Dream. Highly educated, professional individuals in over 40 LinkedIn groups were asked to participate in the survey to answer the following questions:

- What is happening to the American Dream?

- What is today’s definition of the American Dream?

- How are different generations reacting and responding to the American Dream?

- How will this Great Global Recession impact the future of the American Dream?

- How are professionals in the mid-to-upper class responding to the American Dream?

- How will we view careers, retirement, professional development post Recession?

America At Risk

The economy is bouncing back, and many Americans are starting to feel slightly optimistic. However, the current economic climate is going to have a long-term impact on the middle class and the well-educated.

The entire nation lost some of its spunk during the recession that lasted from 2007 – 2009. Even now, in 2011, many people disagree that the recession has ended. Perhaps we are at the beginning of a double-dip recession. Gas prices are rising; home prices are declining; unemployment is lower but many are still unemployed or underemployed; school, cities and state are decreasing funding and programs; and the U.S. Government’s deficit is increasing and they are approving only weekly budgets to prevent a total government shutdown.

There are changing fortunes in America

Many people sense a national decline. Washington

Is America

Wednesday, March 2, 2011

The Jobless Effect: Is the Real Unemployment Rate 16.5%, 22% or…?, Pallavi Gogoi, July 16, 2010

Jobless Workers Who Disappear

Another major source of undercounting is the unemployed who’ve given up looking for jobs. The Bureau of labor Statistics headline number counts as unemployed only people who have actively looked for a job in the previous four weeks. About 2.6 million people had pursued jobs in the past 12 months but, discouraged by the lack of opportunity, had stopped looking altogether.

“Isn’t it interesting that if you stopped looking for a job, you evaporate as a jobless person and are just not counted,” says Gerald Celente, director of Trends Research Institute in Kingstown , NY

According to the Pew Research Center

“Unemployment rate falls as more people stop looking for work,” Kenneth Schortgen, January 7, 2011

The economy needs to create 125,000 new jobs per month simply to keep up with the population demands for work. You will notice that even during December, one of the highest months for hiring due to temporary retail needs, only 110,000 jobs were created, and thus there was a deficit of 15,000 jobs last month simply to stay even with the population.

Secondly, the Labor Department does not record those unemployed who are not out actively looking for work. Once someone falls off the unemployment benefit roles, there is no requirement to apply for jobs to ensure benefits. When these people fall off, they are no longer counted in the unemployment data.

While the economy hiring 110,000 new workers is much better news than we have had in the last three years, at least 250,000 jobs need to be created each month to validate growth. Even with 250,000, it would take at least 28 months of this to employ the more than 7 million who have lost their jobs since the recession began.

The government models tell you the unemployment rate is now at 9.4%. The real data and true unemployment however is at 17%, and will only get higher until we begin to see consistent job creation at least double what December provided.

http://www.examiner.com/finance-examiner-in-national/unemployment-rate-falls-as-more-people-stop-looking-for-work

Secondly, the Labor Department does not record those unemployed who are not out actively looking for work. Once someone falls off the unemployment benefit roles, there is no requirement to apply for jobs to ensure benefits. When these people fall off, they are no longer counted in the unemployment data.

While the economy hiring 110,000 new workers is much better news than we have had in the last three years, at least 250,000 jobs need to be created each month to validate growth. Even with 250,000, it would take at least 28 months of this to employ the more than 7 million who have lost their jobs since the recession began.

The government models tell you the unemployment rate is now at 9.4%. The real data and true unemployment however is at 17%, and will only get higher until we begin to see consistent job creation at least double what December provided.

http://www.examiner.com/finance-examiner-in-national/unemployment-rate-falls-as-more-people-stop-looking-for-work

Comments about the facts

So do you agree with all of these factors comparing the Great Depression with the Great Recession?

Bob M. has some comments:

Over 100 banks have failed. The unemployment rate reached 10% and then declined only because those who ran out of support - 99 weeks - are no longer counted. If you add the unemployed and the underemployed the true figure is probably 20-25%. One out of every six people in this country is experiencing a problem in getting food. One of every four mothers with infants is having a problem affording diapers.

At the same time the situation is not as severe as it was in the Great Depression, when we were still moving from an agricultural society to an industrial one. The movement today is from an industrial society to a service society, which again calls for dislocation and different skill sets.

Those that marketed their goods came out of the depression better than those that pulled back on the marketing expenditures.

In addition: the FDIC reports that 324 banks have failed since 2008, with 25 in 2008, 140 in 2009 and 157 bank failures in 2010. This doesn't count the mega-banks that were bought up during the panic in 2008.

Bank Failures:

Double Dip during the Great Depression

The Great Depression consisted of two major economic dips. The first occurred from august 1929 through March 1933. The second economic decline, known as “Roosevelt ’s Recession,” occurred from May 1937 through June 1938.

Although the American economy is on the rebound – or at least some statistics say so – the current oil crisis, the length of unemployment and the state of the federal government’s budget crisis, we are still at risk for a Double Dip.

Tuesday, March 1, 2011

Protectionism

Protectionism is the economic policy of restraining trade between states through methods such as tariffs on imported goods, restrictive quotas, and a variety of other government regulations designed to discourage imports and prevent foreign take-over of domestic markets and companies. During the Great Depression, there was more protectionism in Europe that in the United States United States

New structures like the G20, European Union Commission and the International Monetary Fund help to curb protectionist policies, but don’t eliminate them. It is still too early to tell how current policies will impact the scale of the Great Recession.

New structures like the G20, European Union Commission and the International Monetary Fund help to curb protectionist policies, but don’t eliminate them. It is still too early to tell how current policies will impact the scale of the Great Recession.

Subscribe to:

Comments (Atom)